Vietnam’s plastics industry is facing mounting challenges as it lags behind regional competitors in technology and innovation. Less than 2% of the country’s 1,500 plastic enterprises have invested in high-tech equipment, leaving most firms reliant on cheap labor and low-value products.

While some companies have successfully exported to neighboring markets such as Cambodia and Laos by focusing on niche products, the broader ASEAN market is dominated by stronger players from Thailand, Malaysia, Indonesia, and the Philippines. These countries are advancing rapidly in eco-friendly and biodegradable plastics, outpacing Vietnam in both domestic and export markets.

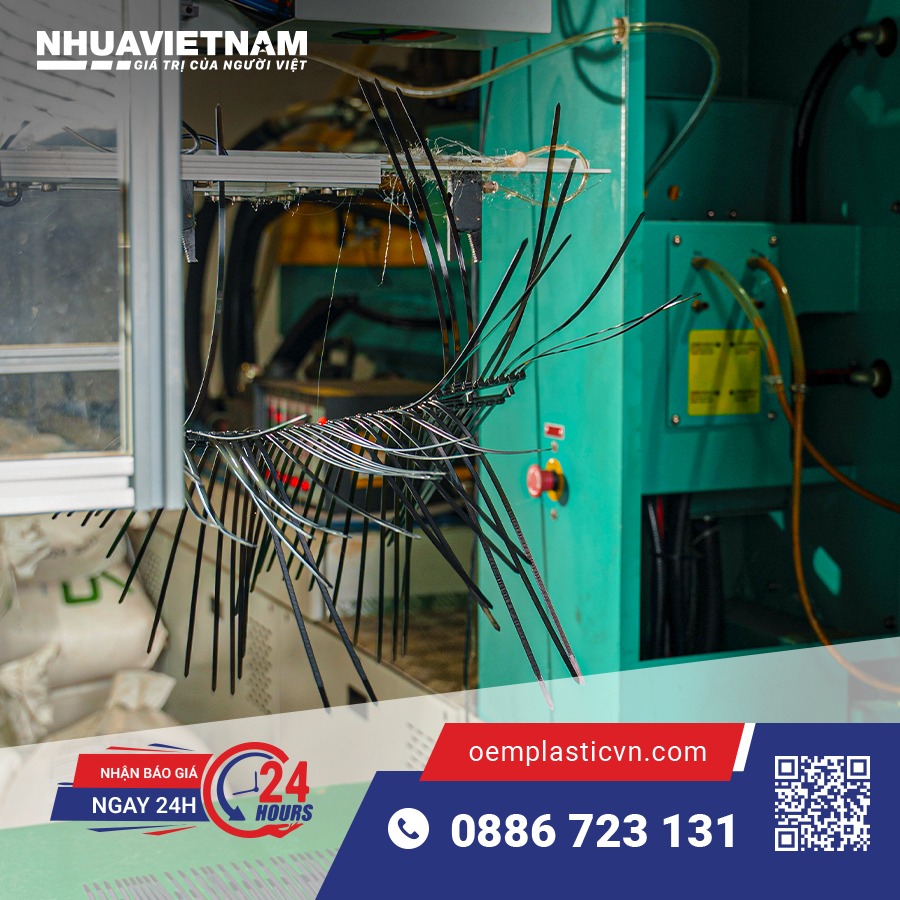

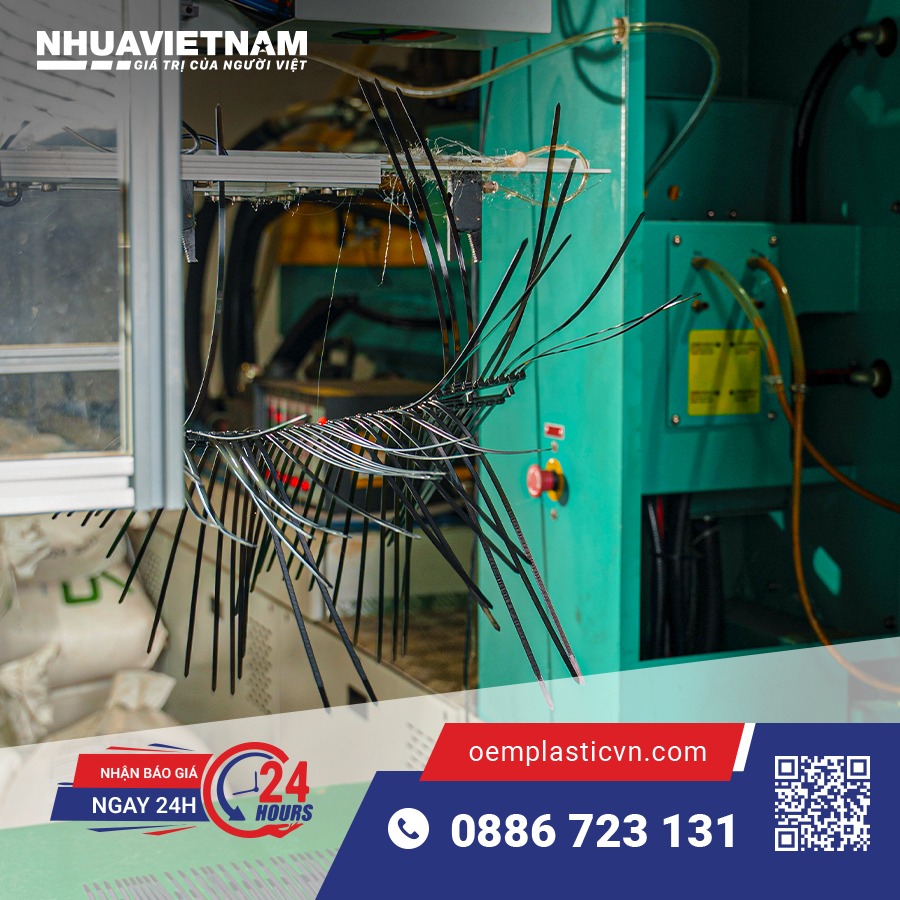

A key weakness lies in raw materials: domestic supply meets only 10–20% of demand, forcing Vietnam to import up to 90%. Outdated technology further undermines competitiveness. High-tech products can fetch USD 3,000–5,000 per ton, yet most Vietnamese firms remain stuck in low-margin segments worth only around USD 2,000 per ton.

Economists warn that without urgent modernization, the industry risks ceding market share to foreign players. Thailand’s SCG Group, for example, has already acquired stakes in several leading Vietnamese plastic firms. Despite the sector’s strong 20–25% annual growth, experts say that without significant investment in advanced technology and sustainable production, much of Vietnam’s plastics market could fall into foreign hands.